Halliburton Company (NYSE:HAL) was upgraded by equities research analysts at Vetr from a "hold" rating to a "buy" rating in a research report issued to clients and investors on Tuesday, MarketBeat.com reports. The brokerage currently has a $42.96 price objective on the oilfield services company's stock. Vetr's price target would suggest a potential upside of 4.91% from the company's current price.

Several other equities research analysts also recently weighed in on HAL. Zacks Investment Research upgraded Halliburton from a "sell" rating to a "hold" rating in a research note on Monday, May 30th. Credit Suisse Group AG restated a "buy" rating on shares of Halliburton in a research note on Thursday, June 2nd. Susquehanna restated a "positive" rating and set a $55.00 price objective (up previously from $47.00) on shares of Halliburton in a research note on Monday, June 13th. Howard Weil upped their price objective on Halliburton from $37.00 to $45.00 and gave the company a "sector perform" rating in a research note on Wednesday, June 15th. Finally, Scotiabank restated a "sector perform" rating and set a $45.00 price objective (up previously from $37.00) on shares of Halliburton in a research note on Wednesday, June 15th. Two research analysts have rated the stock with a sell rating, nine have issued a hold rating, twenty-six have issued a buy rating and one has issued a strong buy rating to the company's stock. Halliburton currently has a consensus rating of "Buy" and a consensus price target of $46.65.

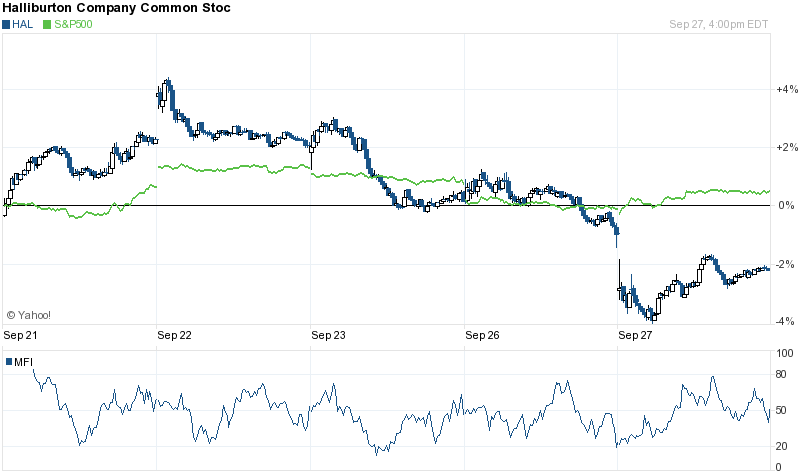

Shares of Halliburton (NYSE:HAL) traded down 1.04% on Tuesday, reaching $40.95. The company's stock had a trading volume of 11,842,888 shares. The stock has a 50-day moving average price of $43.38 and a 200-day moving average price of $41.72. Halliburton has a 1-year low of $27.64 and a 1-year high of $46.90. The company's market capitalization is $35.26 billion.

Halliburton (NYSE:HAL) last posted its quarterly earnings results on Wednesday, July 20th. The oilfield services company reported ($0.14) earnings per share (EPS) for the quarter, beating the Zacks' consensus estimate of ($0.19) by $0.05. Halliburton had a positive return on equity of 3.55% and a negative net margin of 30.50%. The firm earned $3.84 billion during the quarter, compared to the consensus estimate of $3.76 billion. During the same quarter in the previous year, the business earned $0.44 earnings per share. The firm's quarterly revenue was down 35.2% compared to the same quarter last year. On average, equities research analysts forecast that Halliburton will post ($0.17) EPS for the current year.

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, September 28th. Stockholders of record on Wednesday, September 7th will be issued a $0.18 dividend. The ex-dividend date of this dividend is Friday, September 2nd. This represents a $0.72 dividend on an annualized basis and a dividend yield of 1.76%. Halliburton's payout ratio is currently -10.86%.

Hedge funds have recently made changes to their positions in the company. Johnson Financial Group Inc. increased its position in Halliburton by 51.3% in the second quarter. Johnson Financial Group Inc. now owns 2,277 shares of the oilfield services company's stock valued at $103,000 after buying an additional 772 shares during the last quarter. Quadrant Capital Group LLC increased its position in Halliburton by 17.5% in the second quarter. Quadrant Capital Group LLC now owns 2,542 shares of the oilfield services company's stock valued at $104,000 after buying an additional 379 shares during the last quarter. Manchester Capital Management LLC increased its position in Halliburton by 0.4% in the second quarter. Manchester Capital Management LLC now owns 2,354 shares of the oilfield services company's stock valued at $107,000 after buying an additional 9 shares during the last quarter. Citizens Financial Group Inc RI increased its position in Halliburton by 33.4% in the second quarter. Citizens Financial Group Inc RI now owns 2,589 shares of the oilfield services company's stock valued at $117,000 after buying an additional 648 shares during the last quarter. Finally, Harel Insurance Investments & Financial Services Ltd. acquired a new position in Halliburton during the second quarter valued at approximately $120,000. Institutional investors and hedge funds own 79.64% of the company's stock.

About Halliburton

Halliburton Company (NYSE:HAL) is a provider of services and products to the upstream oil and natural gas industry. The Company operates through two segments: the Completion and Production segment, and the Drilling and Evaluation segment. The Company's Completion and Production segment delivers cementing, stimulation, intervention, pressure control, specialty chemicals, artificial lift, and completion products and services.